Freedom from a disconnected world

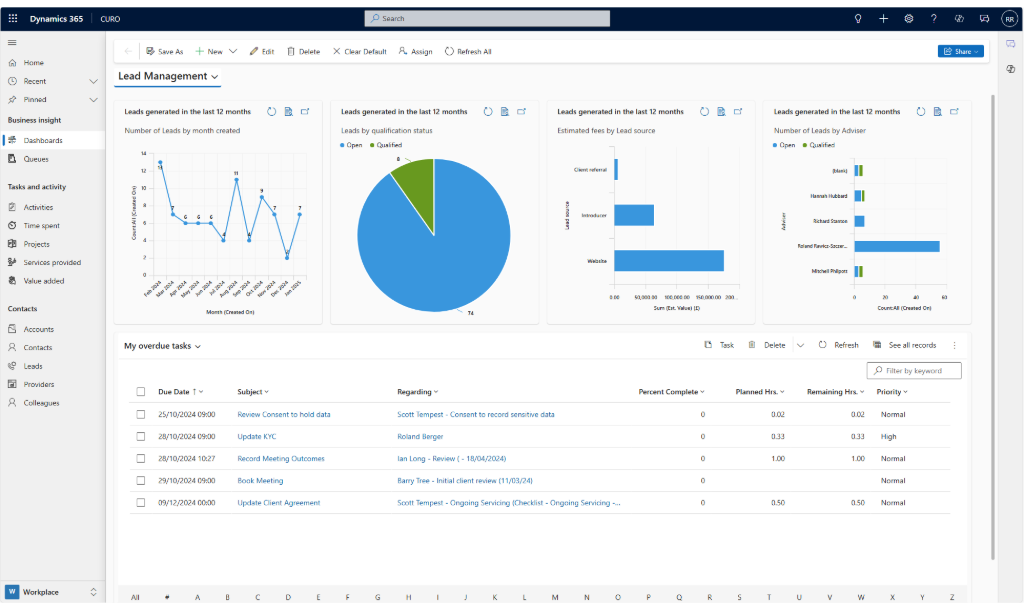

CURO is a modern, enterprise end-to-end Practice Management Solution, built for forward-thinking financial advice and wealth management businesses. Deployed on the Microsoft Power Platform and Dataverse, CURO is not just another proprietary advice system. By extending Dynamics 365 to satisfy the end-to-end needs of advice businesses, CURO also provides world-class CRM and native integration with everyday Microsoft applications (Excel, Word, Outlook, Teams), including Power Apps and an array of third party solutions.

This next generation technology enables firms to leverage the true value of their data and address once and for all, the disconnected world that most advisers suffer every day.

Introduction

Jodie Watling, Director Menzies Wealth Management

Making the most of your data

The world is changing fast and the adoption of digital technologies across all demographics is now the norm. Firms need to be prepared to meet the ever increasing demands of clients for digital engagement, face to face and online. To address this, advice firms must harness their data to enable digital engagement, to drive efficient business processes and automation, as well as to extract powerful insights for decision making and the monetisation of opportunities. To do this, firms must digitally transform themselves in ways that enables data to flow freely and securely throughout their organisation, as well as externally to and from trusted third parties, product providers, and platforms.

The challenge facing advice firms today is that most of the current so-called ‘leading’ adviser back-office systems are built on technology that is 20-25 years old. They were built for the pre-RDR world and were great for handling transactions, but are now ill-equipped to support firms trying to comply with the modern regulatory world of Consumer Duty and beyond.

It's time for change.

Jon Macintosh, Managing Partner, Saltus

Why firms are choosing CURO

By choosing CURO, firms are investing in a strategic solution that satisfies the end-to-end needs of advice businesses now and in the future. CURO’s underlying technologies are underpinned by Microsoft’s ongoing multi-billion-dollar investment in R&D.

CURO is the natural choice of all forward-thinking businesses that do not want to get trapped by the cul-de-sac of legacy back-office systems in common use. In addition, the Power Platform enables CURO to inter-operate with other business systems and services.

Built for now, ready for the future.Matt Lonsdale, Director Davies Consulting

Purposeful digitisation

Consumer Duty is forcing significant change on the financial services industry. Firms are being asked to report on things that were never in vision when the back office systems of old were developed and as a consequence, time and effort is being squandered by highly paid individuals, mashing together data downloaded from outdated systems. The consequence is a spiral of ever increasing costs and business inefficiency.

Due to the nature of the multiple disconnected data silos manifest in every firm, the ability to deliver a cost effective service is diminished, resulting in businesses having to be even more selective with the clients they serve. Consequently, the advice gap is growing as never before. Doing nothing is not an option. Change is the only constant and most importantly, the first sign of madness is doing the same thing and expecting a different outcome. So what needs to happen? Matt Lonsdale, Director of Davies Consulting has an idea or two. Find out more HERE.

Digital Transformation

CURO helps firms digitally transform so that they become more profitable and sustainable. For some advice firms, digital transformation has become more than a way of remaining competitive, it has become necessary for survival. However, digitalisation is not simply taking what you currently do on paper and in spreadsheets and ‘computerising’ it. It is about transforming current processes so that they either no longer need to be done or they are improved to yield greater productivity and operational efficiencies. But at the heart of every digitally transformed business is the recognition that it all begins and ends with data.

CURO delivers unprecedented access to data and helps firms to maximise the benefits of digitalisation.

Digital Transformation. Think Big, Start Small but Just Start

Winners and losers - Don't get left behind

Many advice firms have identified the direction of travel and have started the journey to digital transformation.

This sea change means there will inevitably be winners and losers within the financial planning and wealth management sector. The winners will be those firms that embrace digital transformation and invest in modern technology that supports current and evolving business models. The losers will be firms that either fail to digitalise or choose to stick with existing software solutions that will increasingly restrict a firm’s ability to compete, grow, and meet the changing demands from their clients and the regulator.

Digital transformation is all about ensuring that you are delivering the right service to the right clients at the right price. It is about understanding the business risks and about being able to make the right decisions at the right time but based on reality rather than gut feel. The future is all about data and CURO does data brilliantly.