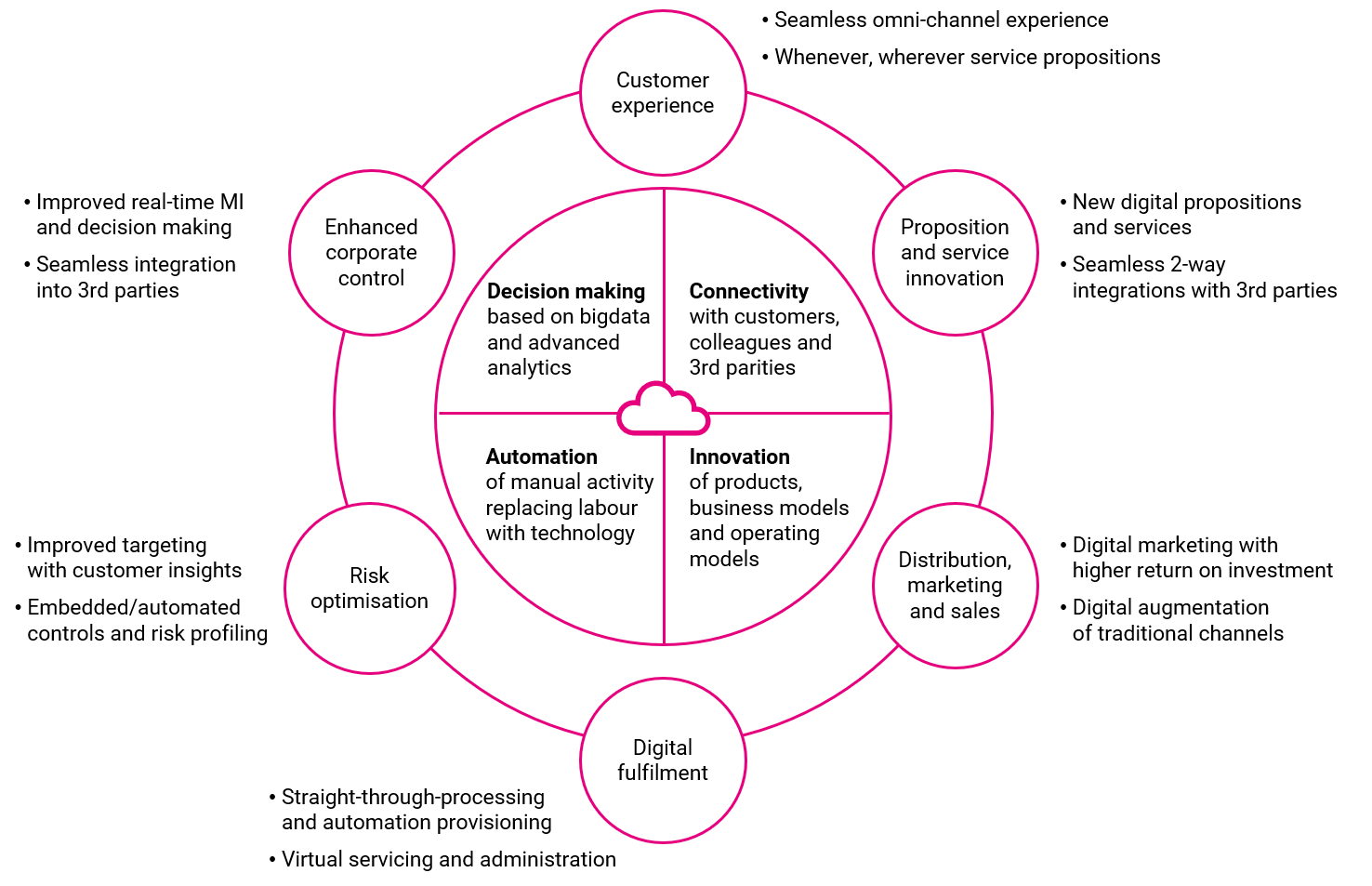

What are the component parts of digital transformation?

Centralised data (single point-of-truth) and data quality

Over recent years, cloud computing has fundamentally changed businesses. It has enabled them to scale both up, and down, quickly. It has also generated significant cost savings by enabling large sets of data to be stored economically to the point where cloud storage has become completely ubiquitous. As a result, data volumes have increased from terabytes to petabytes to zetabytes. Data itself has become a firm’s most valuable asset. This means the focus on cloud computing has changed. It is now about extracting powerful insights from the deluge of data available and using it to drive innovation and create competitive advantage. As a result, to truly harness the power of data, financial advice and wealth management firms must digitally transform themselves in ways that enable data to flow freely, securely and in a structured way throughout their organisation as well as externally to and from trusted third parties, product providers and platforms.

Two-way integrations with 3rd parties

According to recent research by Origo and The Lang Cat, firms are using an average of five systems in the process of giving advice, building portfolios and managing clients. Add on top of this platform usage, and the average climbs to seven. Add in more general systems like accounting and office software and it climbs to ten. The issue isn’t necessarily the use of multiple systems, it is the fact that they are not properly integrated and therefore data cannot flow freely back and forth in a wholly consistent manner.

CURO provides a comprehensive range of out-of-the-box integrations with service providers, product providers and advice tools. CURO also includes a comprehensive set of APIs which can be used to readily integrate with other systems. This means advisers, planners, paraplanners and administrators can perform all their functions without the need for re-keying data across multiple systems. Thus, saving time, improving data quality, and reducing risk through errors.

Automation within CURO and Microsoft solutions

Automating manual tasks is typically one of the fundamental objectives of a digital transformation project. Businesses generally strive for greater efficiency and the optimisation of business processes. Within the CURO/Microsoft world one of the foundations for automation is the use of Workflow.

Workflow is used to automate manual processes, generate tasks, produce documents, and schedule appointments and communications.

Multi-channel, multi-device client experiences

These days clients expect to be able to interact with firms in the way they want to. Whether that’s face-to-face, the telephone or to self-serve online via a Client Portal. The COVID-19 pandemic has also acutely highlighted the need to engage with clients remotely through video calling. Advice firms also have compelling reasons for developing seamless ‘whenever, wherever’ service propositions. These include:

- Improving client experience and servicing

- Reducing the cost of servicing

- Improving the quality of advice given

- Scalability – through the cost-efficient acquisition of new clients and increasing the capacity of advisers

Client engagement and communications

In terms of client engagement and communications, digital transformation means capturing all client engagements and storing them digitally, be that, emails, reports, voice, or video and automatically storing them against the client record. This means advisers, and compliance professionals, have a complete record of client interactions, helping them to build and deliver high-quality advice efficiently and effectively.

Digital transformation can also help to automate communications including emails, letters, reports and the scheduling of appointments. Basic AI functions can also be developed that remind (‘nudge’) clients to take a recommended course of action.

COVID-19 has highlighted the need for advice firms to be flexible in terms of home working and video communications with clients. CURO is natively integrated with Microsoft Teams. This means scheduling video calls and recording them against the client record happens automatically.

Marketing

Digital transformation within marketing generally means two things; automation and personalisation. Marketing works best when it is timely, relevant, and personalised. Having a complete digital history for all client holdings, previous engagements and client objectives helps to deliver marketing campaigns that are more effective and that deliver higher ROI.

It also means that all digital marketing activity including, email marketing, advertising, social media, SMS and client feedback surveys can be unified and automated.

Business Intelligence, on-demand

Data is the fundamental building block for every digital transformation journey. Data quality and system(s) access to data are the first steps that need to be addressed.

CURO unifies data across a firm’s entire business thereby creating a ‘single-point-of-truth’. This means the data can be used by advanced reporting applications such as Microsoft’s Power BI. As a result, firms have on-demand access to all the business intelligence and MI needed to extract powerful insights to make better and faster decisions and to create competitive advantage.